stock market bubble meaning

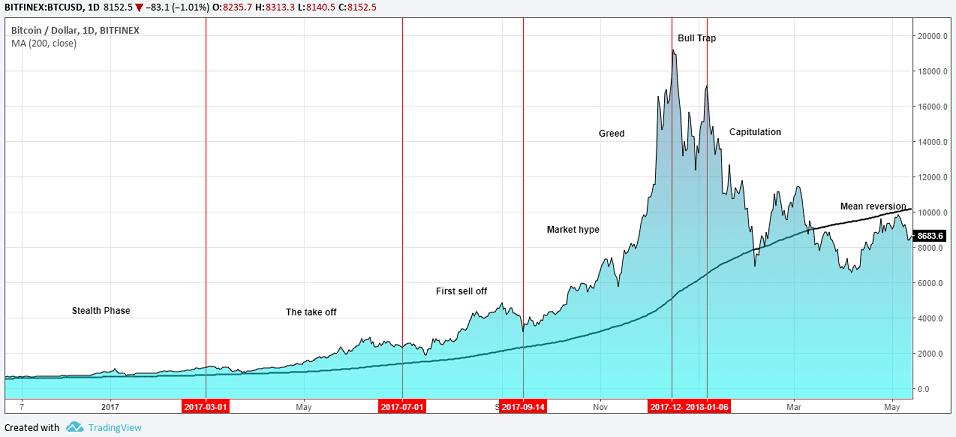

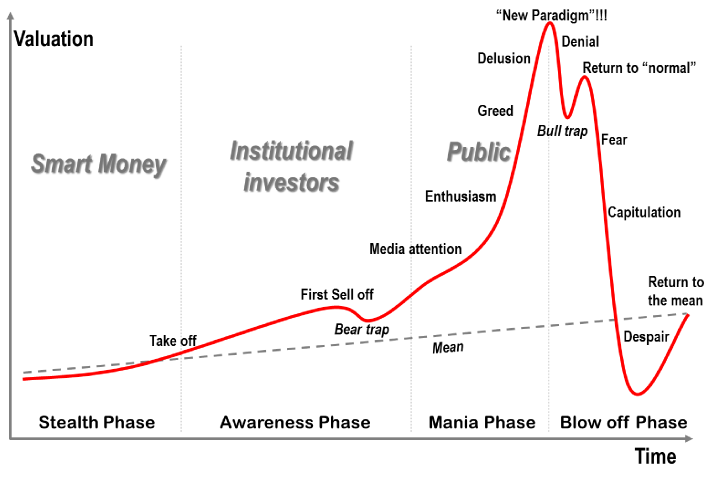

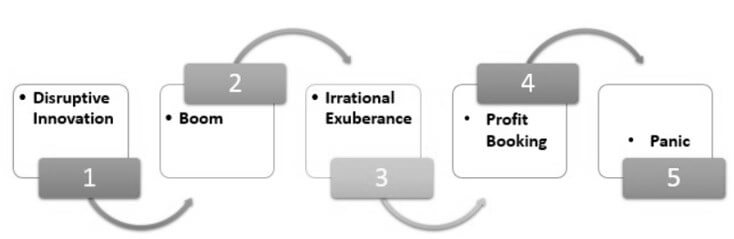

Bubbles occur not only in real-world markets with their inherent. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a period of time well in excess of its intrinsic value.

Biggest Stock Market Crashes In History The Motley Fool

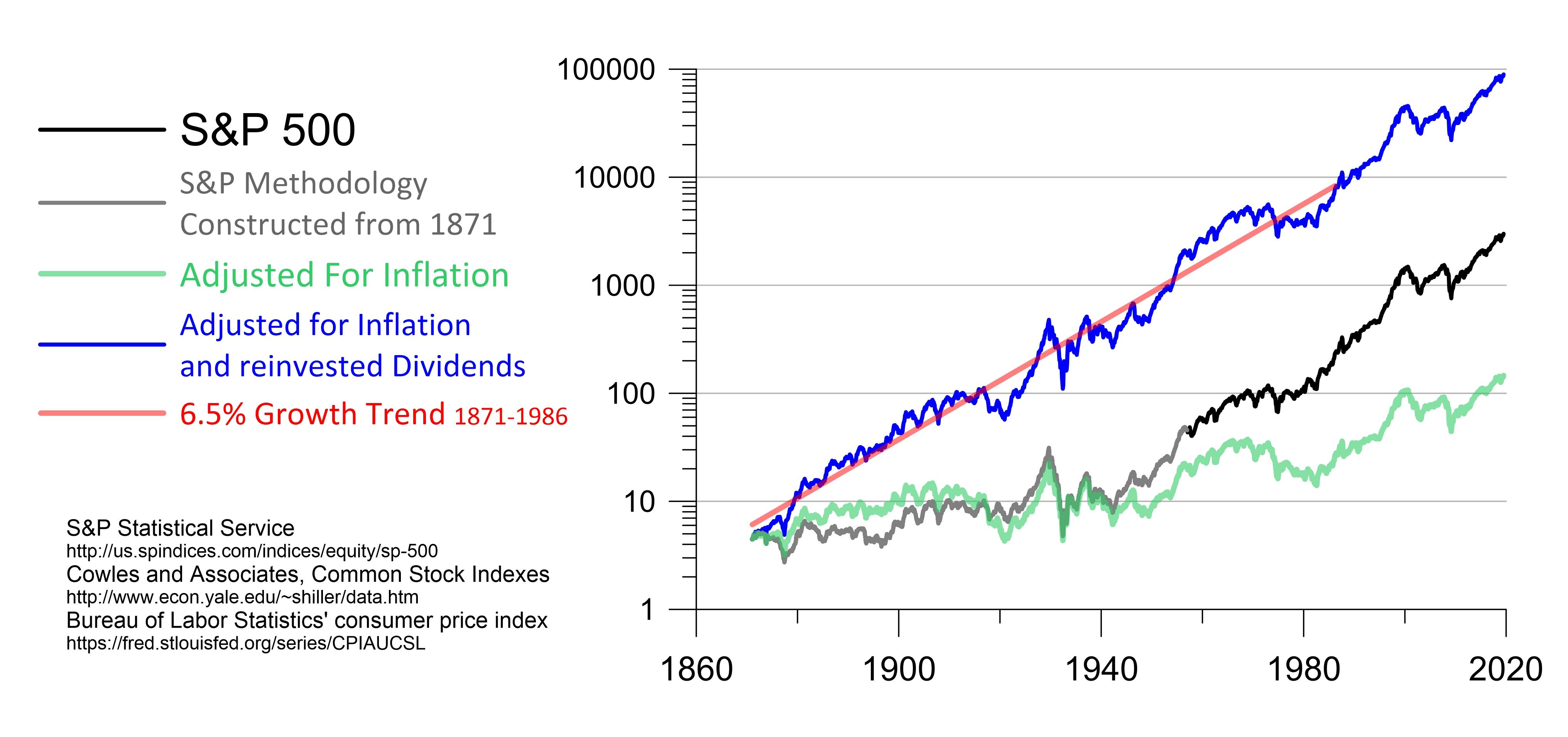

Stocks are an insignificant holding of the US.

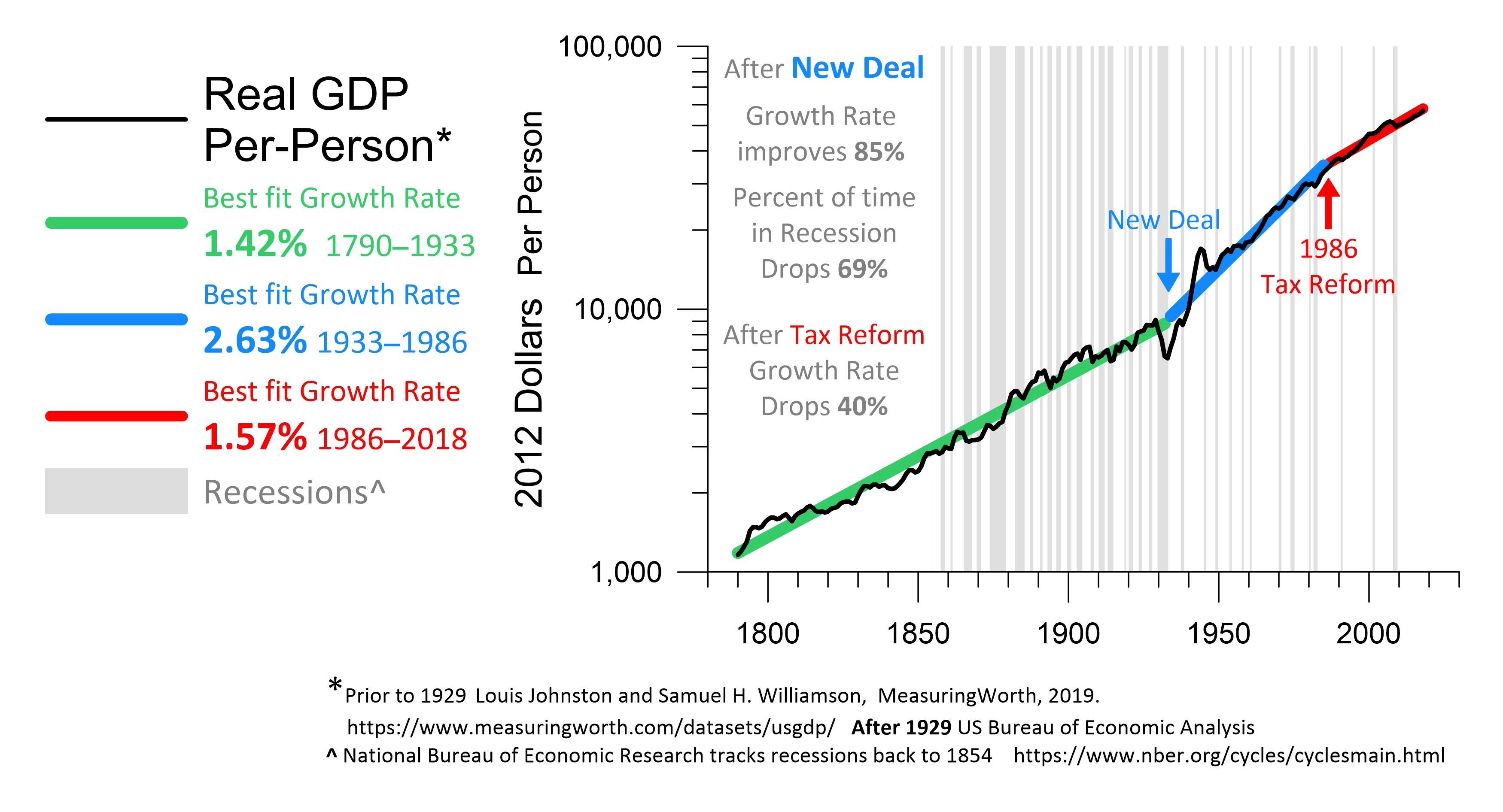

. A companys valuation should be determined by its. Banking system however which was largely unaffected by the NASDAQ bubble although Japanese banks with extensive crossholdings were crippled for. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

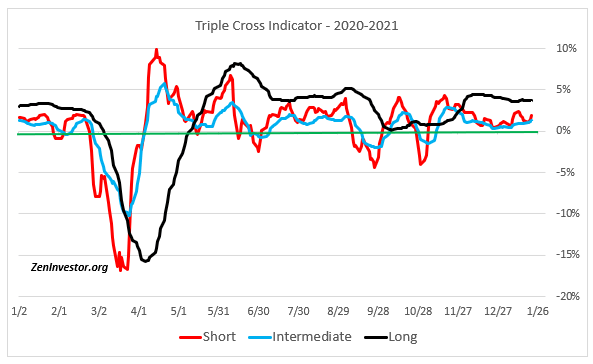

A stock market bubble is a speculative frenzy when stock prices vastly exceed the fundamental value of the companies underlying them. What does STOCK MARKET BUBBLE mean. In my trades I aim to get back three times as much money as I can accept losing.

Grantham added that as bubbles form they give us a ludicrously overstated view of our real wealth. We would like to show you a description here but the site wont allow us. A market crash essentially means that stock prices across various sectors of the market take a sharp decline.

If you put your money in the market you want to get back more than you put in. The term bubble in an economic context generally refers to a situation where the price for somethingan individual stock a financial asset or. A stock market bubble happens when a stock costs a lot more than its worth or the market in general is overvalued.

Stock screener for investors and traders financial visualizations. Many investors start selling their shares at the same time and stock prices fall. A stock market bubble is a period of growth in stock prices followed by a fall.

If the stock market bubble does burst and stock prices take a nosedive use it as an opportunity to load up on quality stocks without. STOCK MARKET BUBBLE meaning - STOCK MARKET BUBBLE definition - STOCK MARKET BUBBLE explanati. A stock market bubble is a period of growth in stock prices followed by a fall.

When this happens on a broad scale a market crash can occur. Followed by a gradual or sudden decline burst in their prices as investors offload their holding in them. This is a very expensive market but its likely not a bubble.

Once a bubble bursts a stock market crash often follows. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place. That makes a trade feel worth the risk for me.

Stock market bubble is a term thats used when the market appears exceptionally overvalued driven by a combination of heightened enthusiasm unrealistic expectations and reckless speculation. What is STOCK MARKET BUBBLE. A bubble is a sudden rise in the prices of stocks belonging to a particular sector buoyed by investor belief in the future performance potential that makes them attain values which are far beyond their intrinsic price.

A market as a whole can also be in a bubble if traders buy. When stock prices fall your investments lose value. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

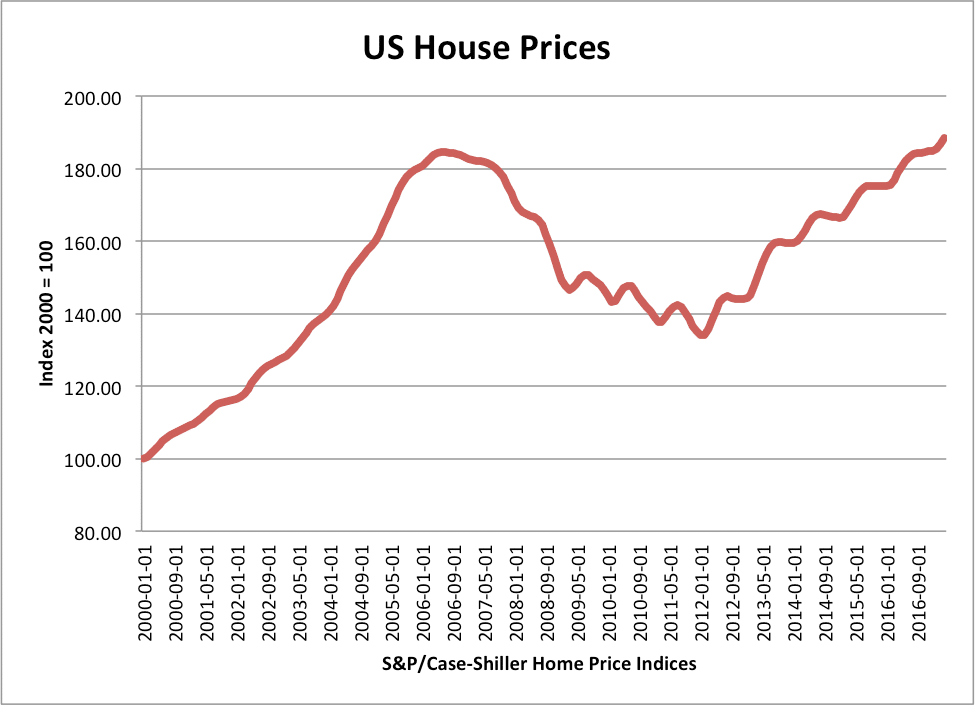

The dot-com bubble and housing market bubble are two notable examples of this phenomenon. A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value. Jeremy Grantham co-founder of hedge fund GMO is warning that stocks could fall a lot further.

Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. A stock market bubble is a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent. While in many respects the stock market looks like a bubble the underlying foundation is different.

Other theoretical explanations of stock market bubbles have suggested that they are rational intrinsic and contagious. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. That doesnt mean it cant go down of course potentially by a lot.

When they fall they do so quickly and often below the starting value. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Since a large part of what appears to be driving prices isnt sentiment the answer is likely no.

Types And Causes Of Financial Bubbles Economics Help

Types And Causes Of Financial Bubbles Economics Help

See How To Identify And Trade Stock Market Bubbles Tradingsim

We Are Now Officially In A Stock Market Bubble Seeking Alpha

Stock Market Bubble Definition Example How To Check

Investors Can T Ignore This Clear Sign Of A Stock Market Bubble Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final_Irrational_Exuberance_Jan_2021-01-45e4d7c38e1f47f290063b49bf234f9a.jpg)

Irrational Exuberance Definition

Stock Market Bubble Definition Example How To Check

What Is A Stock Market Crash Causes Consequences And How To Prepare

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

Stock Market Crash Ahead The 2021 Stimulus Bubble 7 Key Bubble Factors Youtube

What Is An Economic Bubble Definition And Causes Market Business News

Stock Markets Protect Your Wealth From Market Bubbles The Financial Express

We Are Now Officially In A Stock Market Bubble Seeking Alpha

/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)

/wall-street-crash-78075346-08e95275110a4afd80681699e5d72bcb.jpg)